Alexandria, Va. — Leading practitioners will be examining key issues across the consumer bankruptcy landscape at ABI’s 2022 Consumer Practice Extravaganza (CPEX), being held November 10-18 via a state-of-the-art virtual platform. Five broad session tracks will ensure that there is something for every level of consumer practitioner, providing deep dives into student loans, technology and the future, subchapter V of chapter 11, well-being and nontraditional practice. Available at a registration price of only $100, attendees can select sessions from any track, and all sessions will conveniently remain available to attendees for 30 days after the conclusion of the conference. CPEX will also feature a range of special “demo days,” showcasing technology and money-saving tools especially designed for consumer practitioners, as well as plenaries focused on issues relevant to the entire consumer bench and bar.

Sessions at CPEX include:

- If I Were King

- Considerations for Winding Up a Business: A Conversation with Your Client

- Overview of Subchapter V

- Rules 2002 and 7004: Save Your Clients Money on Service

- Working with State and Federal Taxing Authorities

- Using Yoga and Mindfulness to Assist Your Legal Practice

- Intersection of Ethics and Technology

- Monetizing Soft Assets: Lessons for Trustees and Bankruptcy Lawyers

- Post-COVID-19 Mortgage Issues

- The Basics of Student Loans: Acronyms, Payment Plans, Forgiveness Plans and Administrative Discharges

- The Roles and Powers of Trustees

- Networking: Meet Your Judge

- FDCPA, RESPA and More

- The Basics of Chapter 13s and Student Loans

- The New Normal: Virtual/Hybrid Practice

- When Do You Need to Retain a Professional?

- Exiting the Practice: Planned and Unexpected

- Great Debates: Student Loans

- Contingency Planning, Risk-Reduction and Other Security Considerations

- Limiting Noticing Under Rule 2002(h)

- Subchapter V Lightning Rounds and Rods

- The Biden Administration’s Loan Forgiveness Program, the Fresh Start, IDR Recounts and Incorporating Student Loan Changes into Chapter 13 Plans

- How Fulton May Change Practice

- Judicial Roundtables

- A Breakdown of § 523(a)(8) and Case Law Updates

- Ditching the Leatherman Tool and Becoming a HUB

- International Asset-Protection Trusts: Fish or Fowl?

- Domestic Asset-Protection Trusts: The Basics for Bankruptcy Professionals

- Imposter Syndrome

- Bankruptcy for the Deceased: Procedural Nubbins

- How to Bring a § 523(a)(8) Claim

- Non-Linear Law Career Paths

- Tech Tools for Every Practitioner

- The New Normal, Change and the Flow of Water

- The Future of Digital Signatures

Networking is also a key ingredient of CPEX, and attendees will have numerous opportunities to connect. The virtual portal will allow speakers and attendees to video or text chat spontaneously after sessions, or allow them to plan a date and time to meet.

Members of the press looking to attend ABI’s Consumer Practice Extravaganza should contact ABI Public Affairs Officer John Hartgen at 703-894-5935 or jhartgen@abiworld.org.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 10,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abiworld.org. For additional conference information, visit http://www.abiworld.org/conferences.html.

Thursday, October 27, 2022Total Bankruptcy Filings Up Four Percent

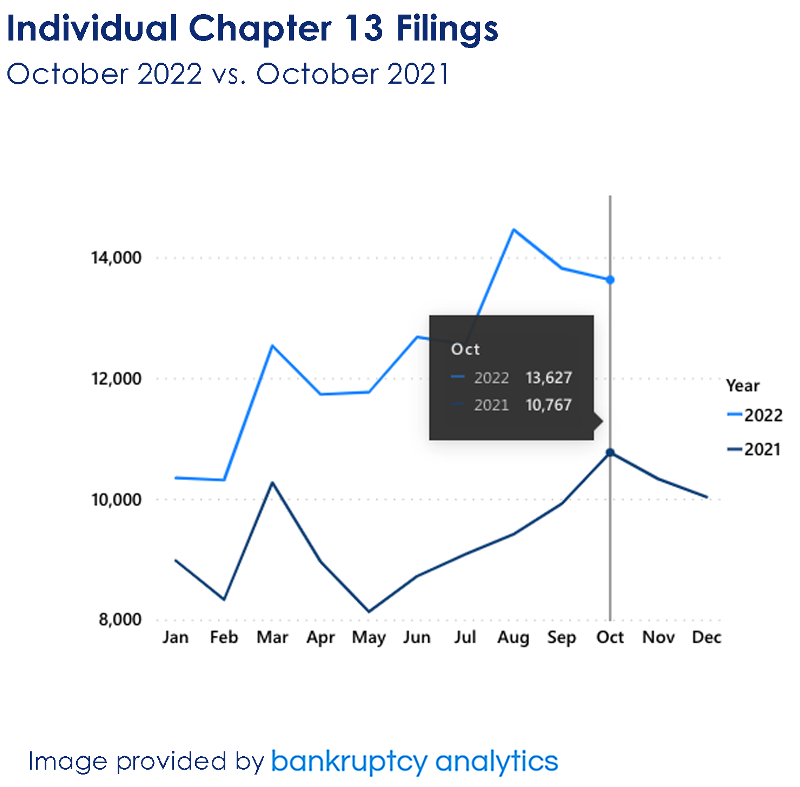

Alexandria, Va. — Consumer chapter 13 filings increased 27 percent to 13,627 in October 2022 from the 10,767 filings in October 2021, according to data provided by Epiq Bankruptcy, the leading provider of U.S. bankruptcy filing data. Total bankruptcy filings in the United States increased 4 percent to 32,695 in October over the 31,493 total filings in October 2021.

Overall individual filings increased four percent in October 2022, as the 30,809 filings were up over the 29,695 individual filings registered in October 2021. The 1,886 total commercial filings in October 2022 represented a five percent increase from 1,798 commercial filings in October 2021. Commercial chapter 11s increased two percent in October 2022, to 304 filings from 297 filings the previous year. Small business filings, captured as subchapter V elections within chapter 11, increased 28 percent to 131 in October 2022 from 102 in October 2021.

“With inflation increasing the costs of goods and services, and with interest rates rising, families and businesses have been presented with tough financial decisions,” said ABI Executive Director Amy Quackenboss. “Though filing rates are still below their pre-pandemic totals, struggling households and businesses are still turning to bankruptcy for relief from mounting economic challenges.”

All filing chapters in October 2022 registered a decrease compared to September’s figures. October’s total bankruptcy filings represented a two percent decrease when compared to the 33,194 total filings recorded the previous month. Total individual filings for October represented a one percent decrease from September individual filing total of 31,179. Individual chapter 13 filings also registered a one percent decrease from September’s individual chapter 13 total of 13,814. The commercial filing total represented a seven percent decrease from the September commercial filing total of 2,015. Commercial chapter 11 filings decreased 32 percent from the 445 filings the previous month, while subchapter V elections within chapter 11 decreased 16 percent from the 156 filed in September.

“While comparing month-over-month or year-over-year filings is one way to determine what's trending in the bankruptcy market, the delta between new filings and closed cases is another valuable capacity metric,” said Gregg Morin, Vice President of Business Development and Revenue at Epiq Bankruptcy.

Not since 2010 have there been more new filings in a year than cases that were closed and it’s trending that way again in 2022, as there have been 61,857 more cases closed than were opened through October 2022 compared to the same period in 2021. For the past four months, the difference has steadily decreased, from 7,627 in July, to 6,516 in August, 5,291 in September, and 3,252 in October.

ABI has partnered with Epiq Bankruptcy to provide the most current bankruptcy filing data for analysts, researchers, and members of the news media. Epiq Bankruptcy is the leading provider of data, technology, and services for companies operating in the business of bankruptcy. Its new Bankruptcy Analytics subscription service provides on-demand access to the industry’s most dynamic bankruptcy data, updated daily. Learn more at https://bankruptcy.epiqglobal.com/analytics.

For further information about the statistics or additional requests, please contact ABI Public Affairs Officer John Hartgen at 703-894-5935 or jhartgen@abi.org.

###

About Epiq

Epiq, a global technology-enabled services leader to the legal industry and corporations, takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action, and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at www.epiqglobal.com.

About Epiq Bankruptcy

Epiq Bankruptcy is a division of Epiq, a global technology-enabled services leader to the legal services industry and corporations that takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at https://www.epiqglobal.com.

About ABI

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 10,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org. For additional conference information, visit http://www.abi.org/calendar-of-events

Thursday, November 3, 2022