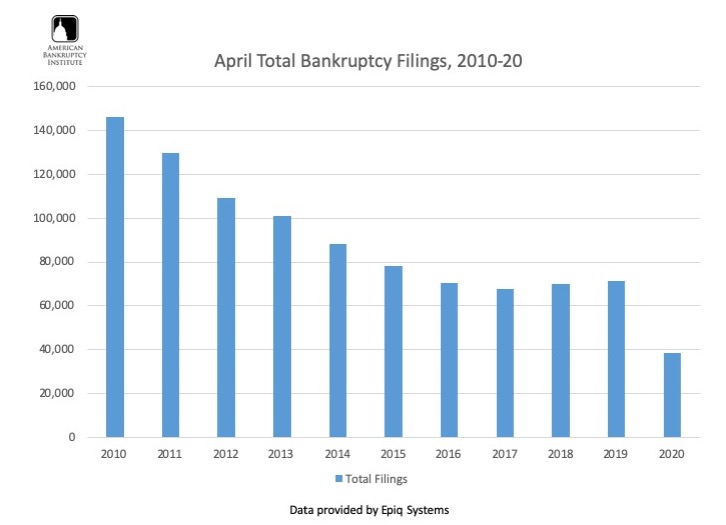

Alexandria, Va.— Total U.S. bankruptcy filings in April 2020 decreased 46 percent from the previous year, according to data provided by Epiq Systems, Inc. Bankruptcy filings totaled 38,428 in April 2020, down from the April 2019 total of 71,303. The 36,150 consumer bankruptcy filings in April 2020 were down 47 percent from the April 2019 consumer total of 67,802. Total commercial filings decreased 35 percent in April 2020, as the 2,278 filings were down from the 3,501 commercial filings registered in April 2019. Conversely, total commercial chapter 11 filings were up 26 percent to 560 in April 2020 from the April 2019 total of 444.

“The extraordinary measures taken by Congress and the Administration to assist individuals and businesses weather the initial economic shock caused by the pandemic have likely staved off bankruptcy filings to date,” said ABI Executive Director Amy Quackenboss. “As financial challenges continue to escalate amid this crisis, bankruptcy is sure to offer a financial safe harbor from the economic storm.”

ABI recently launched its new COVID-19 Resources website for bankruptcy professionals and the public to access essential information and analysis regarding the financial distress being inflicted by the COVID-19 pandemic. The site features exclusive ABI content on the crisis, recommended member analysis, industry sector news, charts and more. New content will be added regularly, so be sure to visit and bookmark the COVID-19 Resources website by clicking here.

April’s total bankruptcy filings represented a 39 percent decrease when compared to the 62,866 total filings recorded the previous month. Total noncommercial filings for April also represented a 39 percent decrease from the March 2020 noncommercial filing total of 59,684. The commercial filing total represented a 28 percent decrease from the March 2020 commercial filing total of 3,182. Commercial chapter 11 filings increased 6 percent from the 530 filings in March 2020.

The average nationwide per capita bankruptcy filing rate in April was 2.09 (total filings per 1,000 per population), a decrease from the 2.29 filing rate during the first three months of the year. Average total filings per day in April 2020 were 3,239, a 3 percent decrease from the 3,323 total daily filings in April 2019. States with the highest per capita filing rates (total filings per 1,000 population) in April 2020 were:

1. Alabama (5.02)

2. Tennessee (4.44)

3. Mississippi (3.99)

4. Georgia (3.78)

5. Delaware (3.52)

ABI has partnered with Epiq Systems, Inc. in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media. Epiq Systems is a leading provider of managed technology for the global legal profession. To view the full monthly statistical tables provided by Epiq Systems, be sure to visit ABI’s Newsroom.

For further information about the statistics or additional requests, please contact ABI Public Affairs Manager John Hartgen at 703-894-5935 or jhartgen@abiworld.org.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 11,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org. For additional conference information, visit http://www.abi.org/calendar-of-events.

Epiq Systems is a leading provider of managed technology for the global legal profession. Epiq Systems offers innovative technology solutions for electronic discovery, document review, legal notification, claims administration and controlled disbursement of funds. Epiq System’s clients include leading law firms, corporate legal departments, bankruptcy trustees, government agencies, mortgage processors, financial institutions, and other professional advisors who require innovative technology, responsive service and deep subject-matter expertise. For more information on Epiq Systems, Inc., please visit http://www.epiqsystems.com.

Tuesday, May 5, 2020