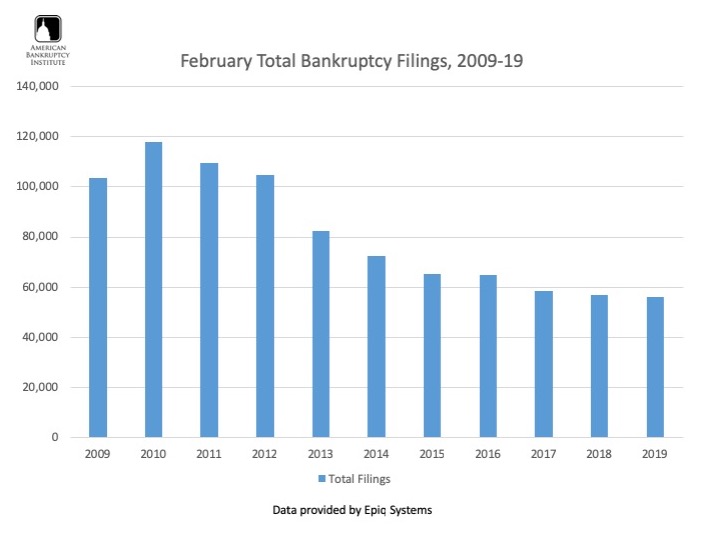

Alexandria, Va. — Total commercial chapter 11 filings in February 2019 increased 60 percent over the same period last year, according to data provided by Epiq Systems, Inc. The 681 commercial chapter 11 filings in February 2019 were up from the 425 commercial chapter 11 filings in February 2018. Total commercial filings were 3,139 in February 2019, representing a 10 percent increase from the 2,862 business filings recorded in February 2018. Total bankruptcy filings decreased 1 percent to 56,118 in February 2019 from the 56,732 filed in February 2018. Consumer filings decreased 2 percent in February 2019 to 52,979 from the February 2018 consumer filing total of 53,870.

“Fluctuating market conditions and high filing costs continue to be a challenge for struggling consumers and businesses seeking the financial fresh start of bankruptcy,” said ABI Executive Director Samuel J. Gerdano. “Both the ABI Chapter 11 Reform Commission and ABI's Commission on Consumer Bankruptcy are working to remove barriers to a financial fresh start for strained businesses and consumers.”

To review the final recommendations of the ABI Commission to Study the Reform of Chapter 11, please click here. ABI’s Commission on Consumer Bankruptcy is preparing to release its final report of recommendations at ABI’s 2019 Annual Spring Meeting, set for April 11-14 in Washington, D.C. To view the ongoing work of the Consumer Commission, including videos of open meetings and prepared witness testimony, please click here.

The February 2019 commercial chapter 11 filing total of 681 represented an 86 percent increase over the previous month’s commercial filing total of 366. February 2019’s 3,139 commercial filings increased 7 percent over the 2,927 filings recorded in January 2019. Total bankruptcy filings, however, fell 3 percent in February 2019 from January’s total of 57,632 filings. Total noncommercial filings also decreased 3 percent from the previous month, from 54,705 filings in January 2019 to 52,979 filings in February 2019.

The average nationwide per capita bankruptcy-filing rate in February 2019 was 2.20 (total filings per 1,000 per population), a slight decrease from January 2019’s rate of 2.23. Average total filings per day in February 2019 were 2,984, a 3 percent decrease from the 3,073 total daily filings recorded in February 2018. States with the highest per capita filing rates (total filings per 1,000 population) in February 2019 were:

1. Alabama (5.25)

2. Tennessee (5.05)

3. Mississippi (4.10)

4. Georgia (4.10)

5. Arkansas (3.53)

ABI has partnered with Epiq Systems, Inc. in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media. Epiq Systems is a leading provider of managed technology for the global legal profession.

For further information about the statistics or additional requests, please contact ABI Public Affairs Manager John Hartgen at 703-894-5935 or jhartgen@abiworld.org.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 11,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org.

Epiq Systems is a leading provider of managed technology for the global legal profession. Epiq Systems offers innovative technology solutions for electronic discovery, document review, legal notification, claims administration and controlled disbursement of funds. Epiq System’s clients include leading law firms, corporate legal departments, bankruptcy trustees, government agencies, mortgage processors

Tuesday, March 12, 2019