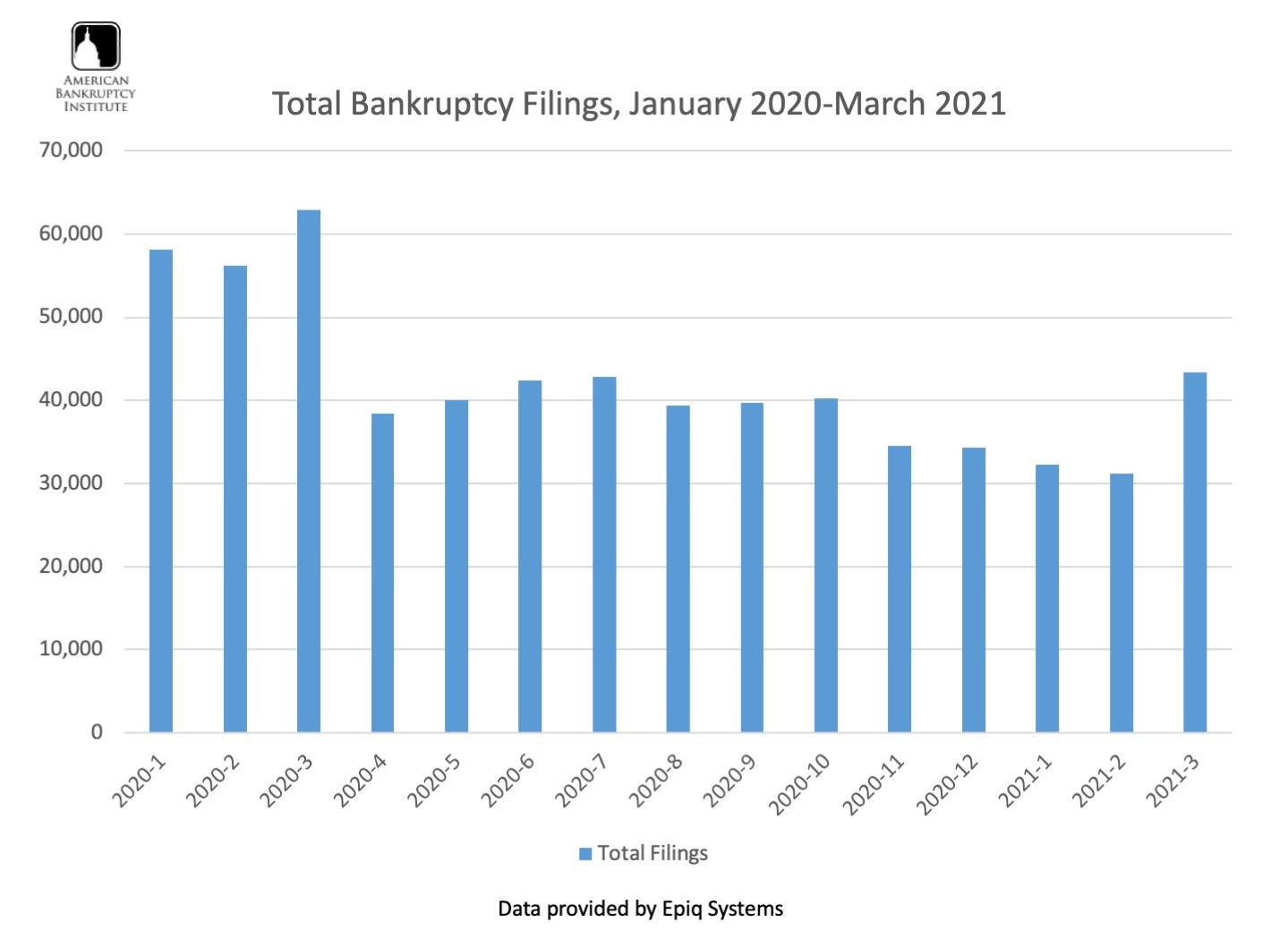

Alexandria, Va. — The total 43,425 bankruptcy filings for March represented a 39 percent increase over the 31,221 filings during the previous month of February, according to data provided by Epiq. Similarly, the 41,150 total noncommercial filings for March represented a 41 percent increase from the February 2021 noncommercial filing total of 29,256. The 2,275 total commercial filings in March represented a 16 percent increase from the 1,965 total commercial filings during the previous month. Commercial chapter 11 filings decreased 9 percent in March to 384 from the 420 commercial chapter 11 filings in February.

“While the government has extended economic stabilization measures and lenders remain flexible to meet the economic hardships of the COVID-19 pandemic, bankruptcy provides a proven shield to families and businesses with mounting debt loads and financial uncertainty,” said ABI Executive Director Amy Quackenboss. “Recent action by Congress and the administration will ensure that households and small businesses continue to have greater access to the financial fresh start of bankruptcy.”

President Joe Biden on March 27 signed the “COVID-19 Bankruptcy Relief Extension Act” into law to extend provisions providing financially distressed consumers and small businesses greater access to bankruptcy relief. The legislation will extend personal and small business bankruptcy-relief provisions that were part of last year's CARES Act through March 2022. Some of the key provisions of last year's relief packages were the increased debt limit to $7.5 million for small business debtors electing to file under subchapter V and allowing individuals to seek COVID-19–related hardship modifications, among other changes. Click here for more information.

For the first calendar quarter of 2021 (Jan. 1-March 31), the 106,958 total bankruptcy filings represented a 40 percent decrease from the 177,246 total filings during the same period last year at the start of the pandemic (filings started showing their largest decreases due to the pandemic in the second calendar quarter of 2020). Consumer filings also decreased 40 percent to 100,669 filings in the first quarter of 2021 from the 167,376 consumer filings during the same period in 2020. Total overall commercial bankruptcies decreased 36 percent in the first quarter of 2021, as the 6,289 filings were down from the 9,870 commercial filings during the first quarter of 2020. Total commercial chapter 11 filings dipped 25 percent to 1,283 during the first calendar quarter of 2021 from the 1,709 total commercial chapter 11s during the same period in 2020.

The average nationwide per capita bankruptcy filing rate for the first three months of 2021 increased to 1.38 (total filings per 1,000 per population) from the 1.23 filing rate of the first two months of the year. States with the highest per capita filing rates (total filings per 1,000 population) for the first quarter of 2021 were:

1. Alabama (3.29)

2. Delaware (2.98)

3. Nevada (2.85)

4. Tennessee (2.56)

5. Georgia (2.27)

ABI has partnered with Epiq in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media. Epiq is a leading provider of managed technology for the global legal profession.

For further information about the statistics or additional requests, please contact ABI Public Affairs Officer John Hartgen at 703-894-5935 or jhartgen@abiworld.org.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 11,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org. For additional conference information, visit http://www.abi.org/calendar-of-events.

Epiq, a global technology-enabled services leader to the legal services industry and corporations, takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at https://www.epiqglobal.com.

Tuesday, April 6, 2021