Alexandria, Va. — While bankruptcies have slightly declined for eight consecutive years, an article in the August ABI Journal highlighted student loan debt as the issue that could have the greatest impact on future filing levels. “How America deals with the student loan crisis could have a substantial impact on bankruptcy filings,” writes Ed Flynn, a consultant with ABI, in his article “How Long Will the Era of Bankruptcy Stability Last?” Flynn previously worked for more than 30 years at the Executive Office for U.S. Trustees and the Administrative Office of the U.S. Courts.

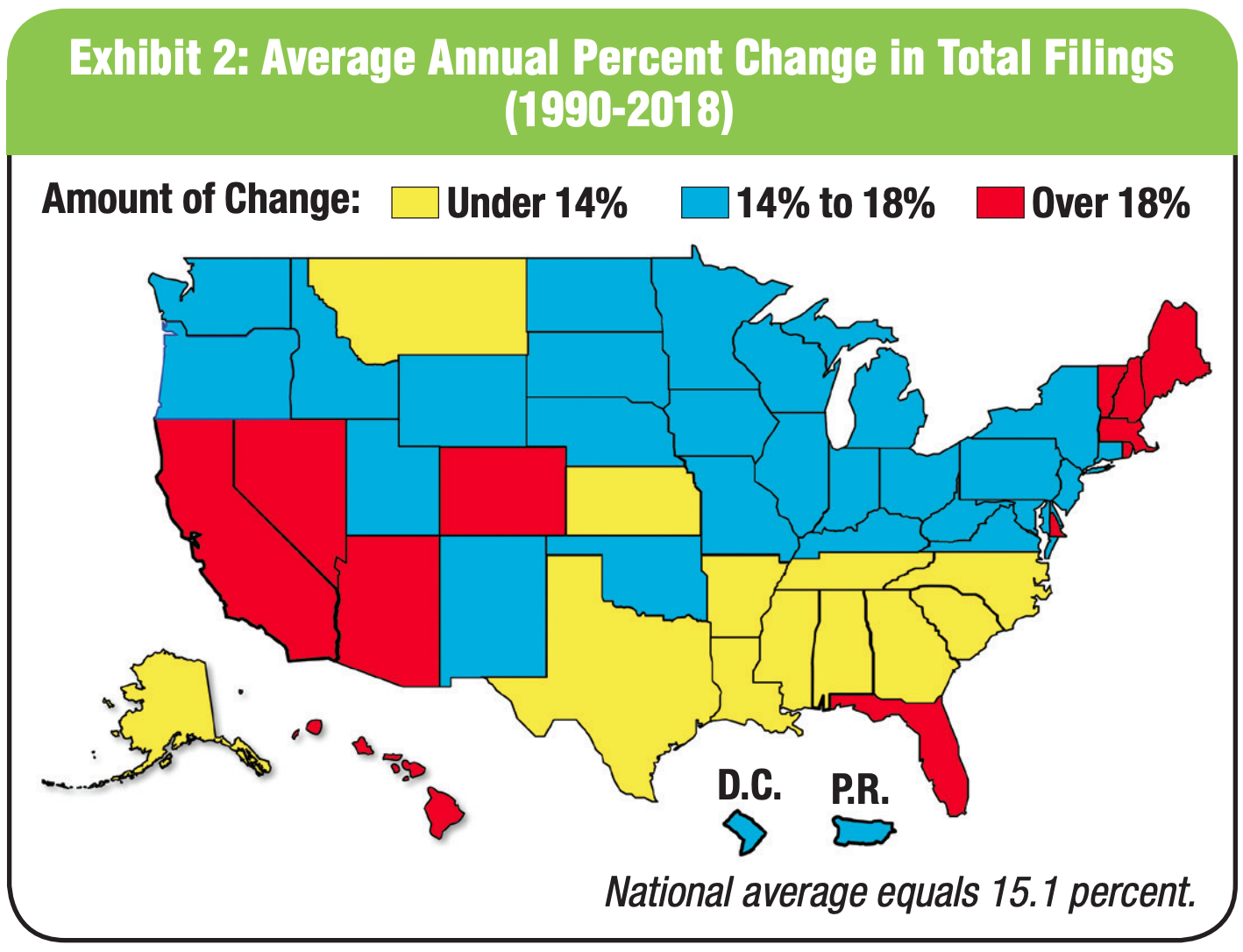

While bankruptcy filing levels have appeared to be fairly stable for the last several years, large annual swings in filings have been far more common over the past 100 years than periods of stability, according to Flynn. “Historically speaking, bankruptcy filing levels are far more volatile than other types of cases in the federal courts,” he writes. Since 1990, the average annual change in total bankruptcy filings (up or down) has been 15.1 percent. Even excluding the filing surge prior to the enactment of the Bankruptcy Abuse Prevention and Consumer Protection Act in 2005 and the subsequent decline in 2006, the annual average change has been 12.4 percent. “By comparison, during the same period, the average change per year in the federal district courts has been 4.7 percent for civil cases and 4.5 percent for criminal cases, and in the courts of appeals, the average annual change in filings has been 4.8 percent,” Flynn writes.

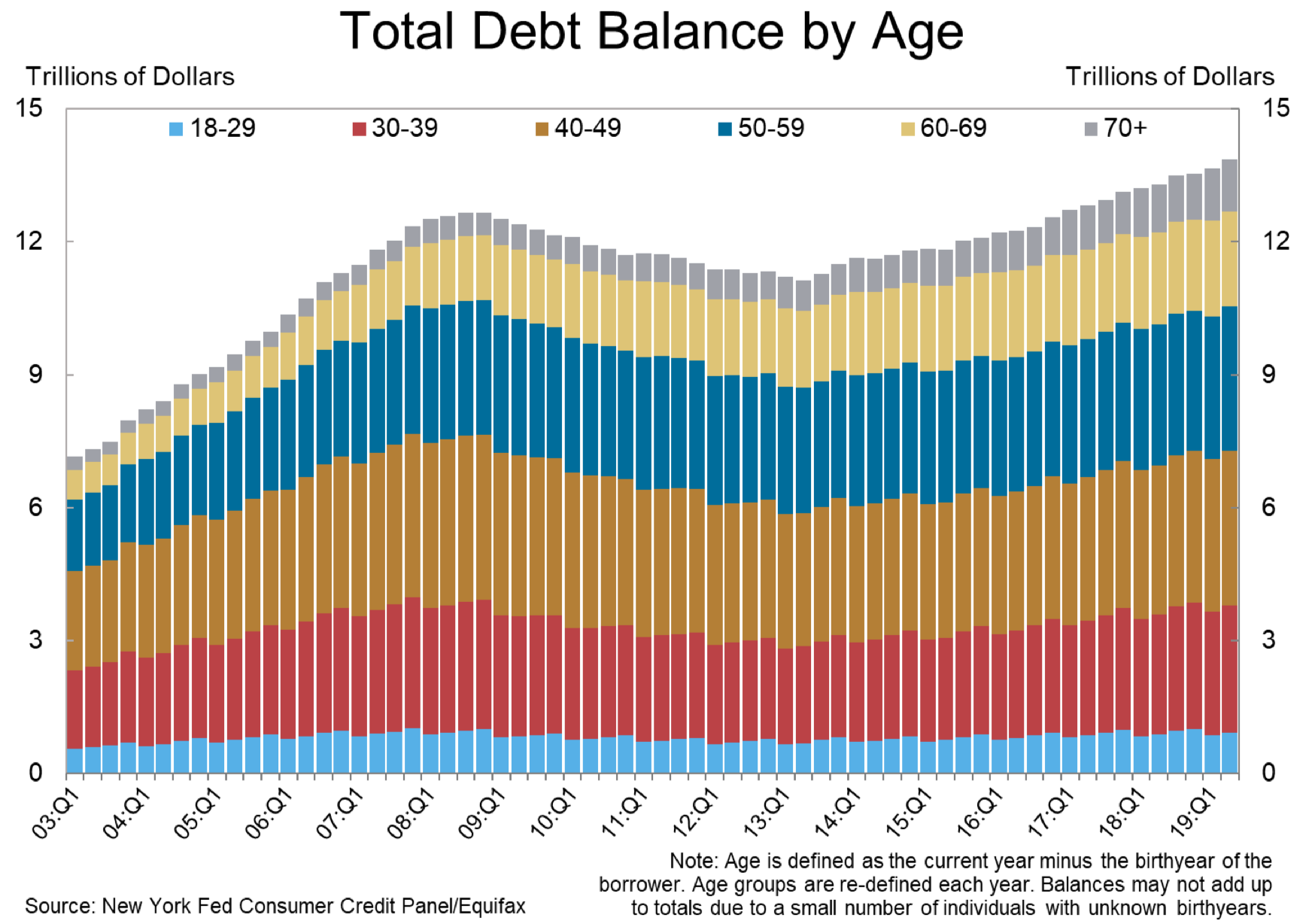

With such historical filing fluctuations and student loan debt now eclipsing $1.6 trillion, Flynn examines proposals to address student loan debt and what the effects might be on bankruptcy filings. “Several Democratic presidential candidates have proposed forgiveness (without bankruptcy) of all or a large portion of student loan debt,” Flynn writes. “If enacted, these proposals would likely lead to a further decline in bankruptcy filings because removal of this nondischargeable debt would allow some potential filers to be able to manage their other obligations without the need for bankruptcy.”

“However, if instead of general forgiveness of student loan debt Congress were to amend 11 U.S.C. § 523(a)(8) to make some or all student loan debts dischargeable, filings could soar to unprecedented levels,” according to Flynn. For example, Flynn cites the "Student Borrower Bankruptcy Relief Act of 2019" (S.141), which would make all student loan debt dischargeable. He said that this proposal would double the amount of delinquent non-mortgage debt that would be dischargeable in bankruptcy. Flynn also highlighted the Final Report of the ABI Commission on Consumer Bankruptcy that contained recommendations that would allow discharge of certain categories of student loan debt.

“For the past several years, the bankruptcy system has had a rare period of stability,” Flynn writes. “However, based on more than 100 years of history, it is unlikely that this stability will last.”

To obtain your copy of “How Long Will the Era of Bankruptcy Stability Last?,” please click here.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 11,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abiworld.org. For additional conference information, visit http://www.abi.org/education-events.

Tuesday, August 20, 2019