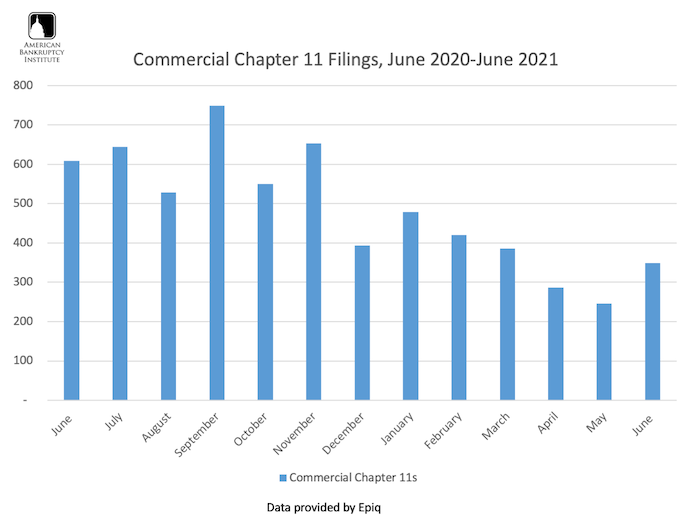

Alexandria, Va.— The 349 commercial chapter 11 filings in June represented a 42 percent increase from the 246 filings in May 2021, according to data provided by Epiq. Total commercial filings in June increased 11 percent to 1,983 from the 1,791 commercial filings in May. Conversely, the 34,269 total bankruptcy filings in June represented a slight decrease from the 34,767 total filings recorded the previous month, and total noncommercial filings of 32,286 for June represented a 2 percent decrease from the May 2021 noncommercial filing total of 32,976.

Total bankruptcy filings were 216,931 during the first six months of 2021, a 27 percent decrease from the 298,121 total filings during the same period a year ago. Total consumer filings also registered a 27 percent decrease, as the 204,767 filings during the first half of 2021 were down from the 280,636 filings during the first six months of 2020. The 12,164 total commercial filings for the first half of 2021 represented a 30 percent drop from the commercial filing total of 17,485 for the first half of 2020. The 2,167 total commercial chapter 11 filings during the first six months of the year (Jan. 1-June 30) were a 40 percent decrease from the 3,610 total filings during the same period in 2020, according to data provided by Epiq.

“Many financially distressed businesses and households have been able to weather the economic effects of the pandemic to this point through stabilization efforts by the federal government, lender forbearance and continued low interest rates,” said ABI Executive Director Amy Quackenboss. “As consumers and companies navigate the post-pandemic economy amid receding relief programs, global supply challenges and potential inflation risks, bankruptcy provides a lifeline to families and businesses who may be struggling financially.”

The average nationwide per capita bankruptcy filing rate for the first six calendar months of 2021 (Jan. 1-June 30) decreased slightly to 1.40 (total filings per 1,000 per population) from 1.41 for the first five months. The average total filings per day in June 2021 were 1,558, a 19 percent decrease from the 1,928 total daily filings in June 2020. States with the highest per capita filing rate (total filings per 1,000 population) through the first six months of 2021 were:

1. Alabama (3.15)

2. Nevada (2.91)

3. Tennessee (2.51)

4. Indiana (2.31)

5. Delaware (2.23)

ABI has partnered with Epiq in order to provide the most current bankruptcy filing data for analysts, researchers and members of the news media. Epiq is a leading provider of managed technology for the global legal profession.

For further information about the statistics or additional requests, please contact ABI Public Affairs Officer John Hartgen at 703-894-5935 or jhartgen@abiworld.org.

###

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 10,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org. For additional conference information, visit http://www.abi.org/calendar-of-events.

Epiq, a global leader in the legal services industry, takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at https://www.epiqglobal.com.

Wednesday, July 7, 2021