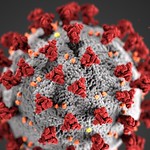

The coronavirus outbreak has closed suppliers in China, but insurance policies meant to protect companies from business interruptions probably won’t cover the losses, the New York Times reported. On Tuesday, the Organization for Economic Cooperation and Development laid out just how bad things could get: If the coronavirus continues to spread, it could cut the year’s global growth by half, to 1.5 percent for the year instead of the 2.9 percent that the Paris-based research group had forecast before the epidemic took off. Many businesses have insurance policies that are meant to kick in when disaster strikes. But few of those policies will cover losses incurred because of the outbreak. Companies typically buy a kind of coverage known as business interruption insurance as part of their property policies, which pays cash to make up for lost revenue when a business has to halt operations unexpectedly. A close relative, contingent business interruption insurance, kicks in when the shutdown is at a supplier of the insured company. At first glance, those might seem perfect for the current epidemic, which has caused quarantines that shut down factories in China, severed links in supply chains and disrupted business activity for hundreds of companies from Microsoft to Marriott. But those policies almost always cite “direct physical loss or damage” as a requirement to get a payment. Read more.

Don’t miss a special abiLIVE webinar on March 10 looking at supply chain disruption & other financial effects of the coronavirus. Register here.